Target Hospitality Corp. and e.l.f. are the top-performing small capitalization stocks this month. Beauty Inc. and Hudson Technologies Inc. were the top-performing small-capitalization stocks this month. The Russell 2000 Index for small-caps dropped 4%, while the Russell 1000 Index fell 7%.

In 2023, investors have invested $4.2 billion in mutual and exchange-traded fund (ETFs), which are focused on small-cap stocks. This compares to outflows of over $17 billion from large funds. Strong labor-market trends and consumer spending could be a boon for small-cap stocks that have historically outperformed their rivals in market recovery periods.

Below, we examine the best small-cap stocks according to three criteria: highest value, fastest growth and most momentum. All data for companies is current as of February 24, and index data as of March 2. Some of the listed companies may have valuations that exceed the $2 billion threshold for small-cap equity. These can happen during high-volatility times, but they’re still small-caps since they aren’t reindexed as quickly as their prices change.

Best Small-Cap Stocks at the Best Value

These stocks are small-cap stocks that have the lowest trailing 12-month price-to-earnings ratio (P/E). A low P/E ratio means that shareholders are paying less per dollar of profit. Profit can be returned in dividends or buybacks.

Sinclair Broadcast Group Inc. This diversified media company owns, operates and provides services for 185 television stations across 86 markets in the U.S. It delivers content through digital platforms and multichannel video program distributors and other avenues.

Jackson Financial Inc. A financial holding company that provides annuities for retail investors in the United States. Its subsidiaries are Jackson National Life Insurance Co., Jackson National Life Insurance Co. New York and PPM America. The company declared a first quarter 2023 dividend of 62.5 cents per common stock, nearly 13% more than the previous-year dividend. As of March 14, shareholders will be able to receive it March 23.

iStar Inc. A real estate investment firm that also offers corporate net lease financing. For the three most recent months of 2022, the company suffered a net loss close to $87 million.

Stocks with small capital growth rates that are fastest

These stocks are small-caps’ top picks, based on a growth model that ranks companies based upon a 50/50 weighting their most recent quarterly year over-year (YOY), percentage revenue growth and their latest quarterly YOY earnings per-share (EPS).

Sales and earnings are crucial factors in determining a company’s success. Ranking companies based on one growth metric is not fair. This makes it vulnerable to accounting anomalies in the quarter, such as changes in tax laws and restructuring costs that could make one figure unrepresentative of the overall business. Outliers were those with quarterly revenue or EPS growth exceeding 2,500%.

DMC Global Inc. This holding company provides architectural building products and metal manufacturing services as well as well completion solutions.

Vertex Energy, Inc. Vertex Energy is an energy transition and environmental services company that recycles industrial waste streams and produces and distributes alternative and conventional fuels. Vertex completed the sale of Heartland’s used motor oil collection business to GFL Environmental in February for $90 million.

Fresh Del Monte Produce Inc. : Del Monte produces, distributes and sells a wide range of fruits and other produce around the world.

Small-Cap Stocks with the Most Momentum

These stocks are small-cap stocks with the highest return over the last 12 months.

Target Hospitality This is a rental and hospitality company. It owns and builds housing communities, and provides rental accommodation and culinary services 9.

e.l.f. Beauty: A cosmetics business that sells lipsticks, creams and skincare products. Net sales increased by 49% and e.l.f. grew by the company’s fiscal third-quarter, which ended Dec. 31, 2022. The company’s fiscal third quarter, which ended Dec. 31, 2022, saw net sales rise by 49% and e.l.f. grow by 150 basis points.

Hudson Technologies – Provides products, services and information related to refrigeration systems for commercial and industrial customers. The company also offers cloud-based management software to manage chilled water plants.

Things to consider when analyzing small-cap stocks

Management Quality – A competent management team is crucial for any company, even a small one looking to establish itself on the market. Potential investors should conduct basic research online about the key personnel within the company such as the CEO and CFO. Are they able to run successful businesses? Check to see if any of the leaders own shares in the company. Stock ownership by company insiders is a sign of commitment to success. It aligns their interests with the shareholders.

Growing Sales Small-cap businesses have limited cash flow, so they need to generate strong sales. Small-cap investors should seek stocks that have strong annual revenue growth rates. This indicates that the company is likely to be a disruptive innovator in its industry and can generate future profits. This information is available on Yahoo! Yahoo! Finance tab shows the company’s revenue over the past four years.

High Operating Margin: An operating margin is the company’s ability to generate profit from its primary operations, before it pays interest and taxes. It is a smart idea to invest in small caps by looking for increasing operating margins. This indicates that the company is capable of turning sales into profit.

Advantages of small-cap stocks

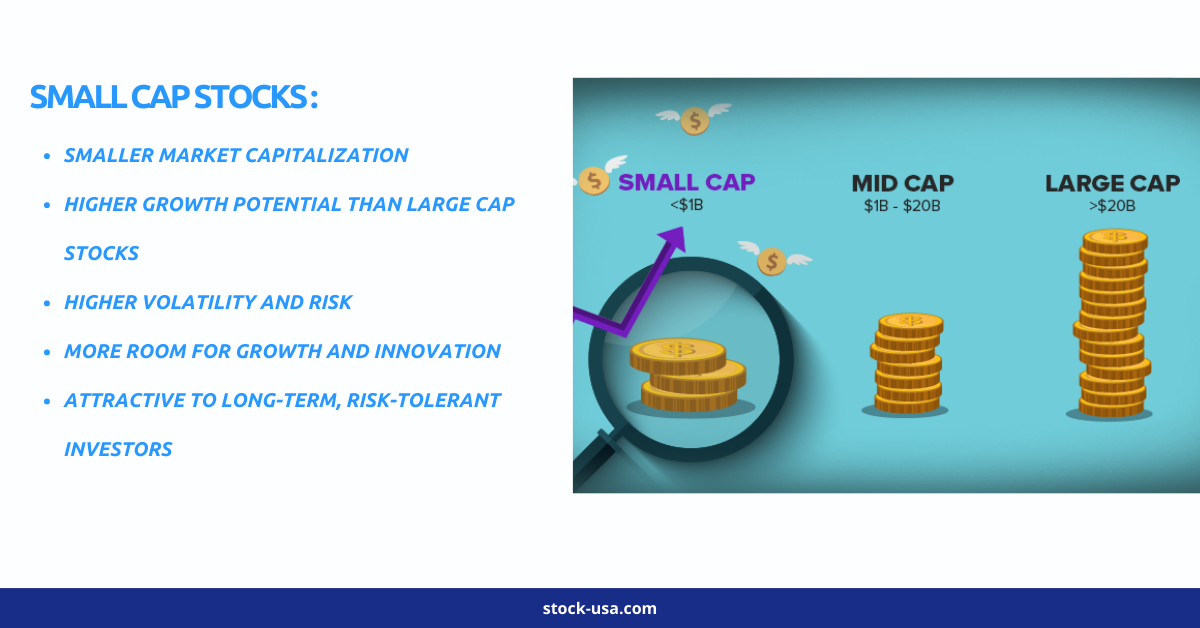

Growth Potential Investing in small-cap stocks can provide significant upside. They allow investors to get in early, before the company becomes a market leader. Small-cap stocks that have a market capital of less than $1 billion can double their value faster than large companies like Amazon and Apple, which have market caps exceedingly high at $1 trillion. This is because it costs far less to move their shares. A small-cap stock with rapid growth can attract Wall Street analysts or institutional investors which can help increase shareholder returns.

Less competition from larger investors: Large-cap stocks are the most popular investment option for institutional investors (banks, hedge funds and REITs). They often ignore small-cap stocks. Retail investors can now buy the story of the future company of tomorrow, without having to compete with Wall Street money.