The stock market is a vast and intricate system composed of various sectors. To help investors make informed decisions about investments, this article will outline the fundamentals of stock market sectors and why they matter so much to investors.

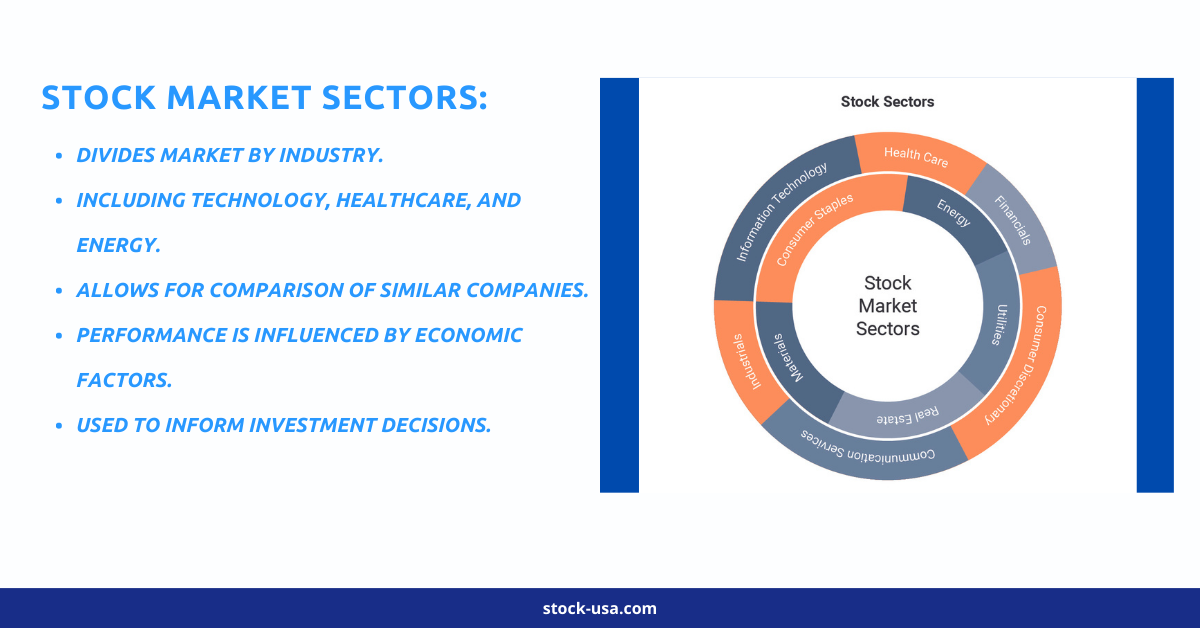

Sectors on the stock market are groups of businesses with comparable goods, services, or market segments. Eleven categories, including technology, healthcare, finance, energy, and consumer goods, may be used to categorize these industries. Investors may target their investments toward businesses with comparable business plans and market dynamics by making investments in a certain industry.

Technology is one of the most sought-after industry segments. Businesses like Apple, Microsoft, and Amazon are market leaders in their respective industries, and customers utilize their goods and services all over the globe. While investing in this industry may have substantial growth potential, it’s important to understand the possible dangers associated with buying particular stocks.

Another popular stock market sector is healthcare. Companies such as Johnson & Johnson, Pfizer and UnitedHealth Group provide essential services and products around the world, making this sector an attractive investment option for those seeking stability and long-term growth.

The financials sector is an essential sector in the stock market. Companies such as JPMorgan Chase, Wells Fargo, and Bank of America make up this group and offer various services like banking, lending, and investment management. Investing in this sector can be a beneficial way to diversify one’s portfolio while offering steady growth prospects.

The energy sector is another essential area in the stock market. Companies such as ExxonMobil, Chevron and ConocoPhillips are involved in producing and distributing oil, gas and other energy resources. Investing in this sector may offer growth prospects as well as income potential; however it’s essential to be aware of potential risks related to commodity prices fluctuations and global supply/demand imbalances.

The consumer goods sector is a popular area in the stock market. Companies such as Procter & Gamble, Coca-Cola, and Nike manufacture essential items that consumers use daily; making this sector an appealing investment prospect for those seeking stability and long-term growth.

Overall, understanding stock market sectors is essential for any investor looking to make informed investment decisions. By researching and analyzing different sectors, investors can identify growth opportunities, diversify their portfolios, and minimize risks. Whether you’re a novice or experienced investor, being familiar with the basics of stock market sectors can help them make smart and profitable investments.